- Renewable Energy

- Posted

Papered Over

Richard Douthwaite reveals that oil and gas peak are barely mentioned in the Government's recent energy Green Paper.

Most Construct Ireland readers have been aware for some time that when the peak in global oil production is reached, it will be an event of massive historical significance. They know that the peak will mark the end of the expansionary, growth-oriented world in which they make their living and the advent of an era of contraction, scarcity and decline where income sources might be hard to find.

Opinions differ about when the peak will occur. Estimates range from “anytime now” to “in about thirty years”. The oil industry banker Matthew Simmons once commented that the world will only know for sure when the peak has happened by looking “in the rear-view mirror” some time after it has taken place. But that mirror already shows that one peak has occurred. This is the peak in the world production of light, sweet oil, the type found in the North Sea and elsewhere which is the best oil for petrol production.

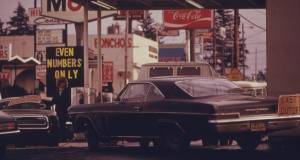

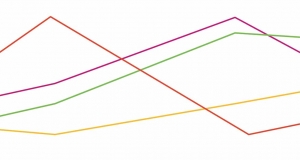

As sweet oil output is already in decline, the debate has now switched to when the peak in heavy sour oil might happen. Sour oil is the high sulphur type that is found in the Middle East and which needs special refining capacity to get the sulphur out. Illustration 1 shows how total world production of both types of oil has run recently. The graph makes it clear that, while output is not yet falling, it is certainly not increasing. Could the resulting plateau be the peak itself and the prelude to an imminent decline? Only the rear-view mirror will enable us to tell. However, the graph indicates that it will be very difficult for the oil industry to increase production enough for world oil consumption to expand at even 1% a year from its 2005 level, as indicated by the shallower hatched grey line. If oil consumption does not increase, world economic growth will be constrained.

Since this country is one of the most heavily dependent on oil in the EU and our export success is closely linked to the growth of the global economy, you would think that the Irish government would be keeping a close eye on when oil peak might occur and developing policies to deal with it. Well, the Department of Communications, Marine and Natural Resources, which is responsible for developing energy policy, might be doing so, but there was no evidence of that in the Green Paper “Towards a Sustainable Energy Future for Ireland” it issued in early October.

The Paper's only mention of oil peak is a single sentence on page 23, stating “These trends combined with other factors such as concerns over peak oil production will likely result in increasingly high and volatile prices, particularly for oil and natural gas” Would Minister Dempsey claim that this is an adequate treatment of the implications of a crucial turning point in global energy use and in the historical pattern of economic development?

Indeed, the question has to be asked “Does the Minister's Department ever look at studies produced by other arms of government?” Last April, Forfás produced a report “A Baseline Assessment of Ireland's Oil Dependence: Key Policy Considerations” calling for “a national strategy in preparation for the challenge of peak oil.” This report is not even referenced in the Green Paper although the Forfás document said that the Green Paper “provides an opportunity to incorporate such a strategy” - an opportunity which the Department clearly missed.

Strangely, though, when Forfás submitted its comments on the Green Paper to the Department in November, it made no reference to the need to develop a strategy to cope with the oil peak at all. Why? And why were none of the policy recommendations it made in April repeated in November? So, while Forfás was calling for such things as the electrification of heavily-used public transport routes and for greater consideration for distributed electricity generation in the Spring, by the Autumn it was limiting itself to a very a conventional, non-controversial shopping list on which price competitiveness, generation adequacy and the greater use of smart meters are the main items. Was Martin Cronin, the chief executive of Forfás and the man who wrote the Foreword to A Baseline Assessment censured for encroaching on the DCMNR's territory?

The Baseline Assessment report itself was based on one commissioned by Forfás from the Amárach consultancy which worked on it with the help of Dr. Robert Hirsch, the lead author of a United States government study on oil peak. The Amárach study was delivered to Forfás last February. Its Executive Summary states:

Our analyses of the timing of peak oil suggest that there is a probability greater than 50% that the peak will occur sometime in the next 15 years. We consider this probability to be sufficiently high to warrant preventative measures in Ireland to mitigate some, though probably not all, of the consequences of the onset of a permanent shortage of global oil supplies relative to the amount required to support sustained economic growth....

Ireland is especially vulnerable to the consequences of a peak oil induced shock to the world economy. The timing of mitigation strategies is critical – on a global scale, it is likely that it will take 20 years before the onset of peak oil to put in place adequate measures, practices and technologies to fully offset the consequences of a permanent oil supply shortfall. Leaving the onset of mitigation strategies until peak oil is imminent or has occurred will inevitably lead to a gap in energy availability relative to the requirements of a growing economy and population.

Since the Green Paper fails to discuss oil peak, it is scarcely surprising that it ignores the the certainty that, at some time in the future, a gas peak will occur too. It does, however, point out that the UK market is now the source of some 80% of Ireland's natural gas and that Britain has become “a significant importer of gas itself.” However, it contents itself with the hope that:

UK regulatory reforms and developments in the UK’s own supply/demand balance (e.g. the planned increase in gas supply capability and diversification of supply sources including LNG) will benefit Ireland in the medium term and influence the security and cost competitiveness of gas. The Government will continue to monitor carefully developments in the UK.

Monitoring developments, however carefully it is done, may not be enough. A major November 2006 report on the adequacy of gas supplies to Britain, “Mind the Gap: The Black Hole at the Heart of the UK's Energy Supply” prepared by the LogicaCMG consultancy, says that an inadequate gas supply could result in peak-time energy gaps of as much as 23 per cent by 2015, equivalent to London and the South East losing supply for several days each winter. “The economic impact of such a gap could be as much as £91 - £108bn to the UK economy.” As the precariousness of Britain's gas supply is not well known in Ireland, it is worth quoting a section of this report at length:

Even given the contributions from Norwegian supplies and from LNG [liquid natural gas], by around 2014-2015 the UK will need to import significant quantities of gas and oil from other sources, initially from Europe and then from further afield. Questions have already been raised about the potential political instability of some of the ultimate sources of these supplies. More worryingly, however, recent events have shown that even the supplies of gas from continental Europe cannot be relied upon. In the early part of 2006, cold weather in the UK meant that gas prices here reached unprecedented levels; but European companies nevertheless chose not to sell additional gas to the UK, in spite of the attraction of high prices. Their traditional public service obligations, coupled with slow progress in market liberalisation, mean that continental utilities are unwilling to sell gas from their storage to the UK that they may need for their domestic customers, even if this would net them a handsome profit.

The situation was highlighted with unprecedented clarity on 13 March 2006, when, following a fire at the Rough storage depot, and with heavy snowfall occurring in Scotland, National Grid issued its first ever Gas Balancing Alert. This was to warn gas shippers and traders, as well as industrial users, that demand for gas was in danger of exceeding supply - in which case action might have to be taken to cut off some industrial users. As a result, the spot price of gas in the UK quadrupled, to something approaching £2.50/therm - but this was still not enough to cause additional supplies of gas to be released from continental Europe. Even at such record prices, the interconnector continued to operate at only something like 50 per cent of capacity.

Arguably the most serious implication of this is that, if urgent action is not taken to resolve the situation and guarantee future supplies (and it is by no means clear what form such action could take in a free market), the large-scale industrial users of gas who could be cut off in future events of this type include the operators of gas-fired power stations. Many of these purchase their gas under long-term interruptible contracts, not least because the price of gas under this type of contract is lower. And with approximately 40 per cent of the UK’s gas consumption being used to generate electricity, and up to two-thirds of the UK’s electricity potentially being generated using gas by 2020, as discussed in the following section, a major interruption to gas supplies could have a calamitous impact on the generation sector.

Click to view large image

World production of crude oil is represented by the darker grey area above. The lighter grey area is the contribution made to the global oil supply by natural gas liquids, the light oil produced as a bi-product of natural gas production. It will be seen that world oil production reached a peak sometime early in 2005 and has since been on a plateau despite the very high prices. Production is certainly not increasing at the rate required to keep up with the expansion of the world's population (the constant barrels per capita line) nor the forecasts made by the International Energy Agency and the US government's Energy Information Agency. Source

If Britain has the choice of keeping its own lights on, or sending gas to Ireland to keep the lights on here, what will it choose? Won't it do exactly what the continental utility companies did to it last winter?

In any case, where will Britain find Ireland's gas? Russia currently supplies a quarter of the EU's gas, 80% of which passes through Ukraine and the rest through Belarus. Questions about the reliability of these supplies have been asked since gas passing through the Ukraine was blocked early in 2006 and Belarus threatened to turn off the pumps in December. There are also questions about Russia's ability to maintain its current gas deliveries. “Only massive capital spending, and immense luck would make it possible for Russia to meet projected gas export demand in the 2009-2015 period” energy expert Andrew McKillop wrote on the Energy Bulletin website in December. “Put another way, peak gas, for Gazprom and its down-the-gas line consumer customers, is likely to arrive quite early, about 2009”. He explained that as Russia increasingly found it needed to tap more, smaller and further gasfields to maintain production, its costs would spiral and a lot more development time would be required.

Russian gas from Siberia has to travel 5,000 kilometres before reaching households and industrial companies in Western Europe after seven days.The Green Paper's authors were simply too lazy to look at these issues because that would have involved them in developing new policies, which would, in turn, have meant more work. They were also too lazy to think in any depth about climate change. So, although the Green Paper continually mentions the need to reduce greenhouse gas emissions, it totally fails to take the consequences of doing so on board. In particular, it believes that Irish energy use will continue to grow by between 2% and 3% a year until 2020. So it might, but that growth would not only involve the purchase of what is likely to be increasingly expensive energy on world markets but also the purchase of emissions permits for Phase Three of the EU's emissions trading system. This phase runs from 2013 onwards and is likely to set very much more stringent emissions reduction targets than Phase Two, which starts next year. As a result, the price of the emissions permits will be several times their current level.

Former German Chancellor Gerhard Schroder with Russian President Vladimir Putin in more stable times attending the signing of an agreement in 2005 between German energy company BASF and Gazprom to supposedly secure Europe's energy supply

If the prospect of these higher prices had been considered and the consequences for the economy of having to import large quantities of increasingly expensive fuel had been explored, then the Green Paper might have suggested responding in the way the Swedish Government is doing. By 2020, Sweden is planning to completely end the use of oil for heating residential and commercial buildings. It will also cut the consumption of oil in road transport by 40-50 per cent and get industry to reduce its consumption of oil by 25-40 per cent by the same date. By replacing this oil, all of which is imported, with energy from its own renewable resources, the Swedish economy will become much more stable, sustainable and secure than its Irish counterpart. Its energy prices will be more predictable and it will have more people employed meeting its own needs rather than producing goods for sale in unstable export markets to earn the income to buy its fuel.

Ninety-seven organisations and individuals had submitted comments on the Green Paper when the period for doing so ended on December 1st, and these are now posted on the DMCNR website. The shocking thing about these submissions is that only those from the Green Party, Feasta, Friends of the Earth, the Consumers' Association, Chambers Ireland and a handful of private individuals mention oil peak or take the Department to task over the inadequacy of its emissions-reduction proposals. The rest of the submissions reveal corporate and institutional thinking which is just as lazy as the Department's was when it drew the Green Paper up. The future be damned. Finding ways to continue Business-as-Usual is their only concern. How will such responses look in the rear-view mirror? Who was it who said “Countries get the governments they deserve?”

- Articles

- renewable energy

- Papered Over

- energy

- green paper

- Oil Peak

- gas

- Minister Dempsey

- forfas

- economic impact

- Richard Douthwaite

- national grid

Related items

-

EU proposes gas demand reduction plan till spring

EU proposes gas demand reduction plan till spring -

The world energy crisis 2022

The world energy crisis 2022 -

Grant heat pumps at centre of NI energy transition project

Grant heat pumps at centre of NI energy transition project -

SEAI Energy Awards 2020 open for entries

SEAI Energy Awards 2020 open for entries -

The first oil crisis

The first oil crisis -

The Jodrell Bank grand challenge

The Jodrell Bank grand challenge -

SEAI Energy Show back at RDS on 27 & 28 March

SEAI Energy Show back at RDS on 27 & 28 March -

A brave new world: Oil and architecture

A brave new world: Oil and architecture -

Energywise Ireland open new renewables showroom

Energywise Ireland open new renewables showroom -

New homes data reveals extent of Irish low energy revolution

New homes data reveals extent of Irish low energy revolution -

Together in Electric Dreams

Together in Electric Dreams -

Use all your solar electricity at home rather than export it — Warik Energy

Use all your solar electricity at home rather than export it — Warik Energy